Each quarter FastMarkets and Sucden Financial produce an analysis and forecast report on the precious and base metals – The Sucden Financial Metals Reports, July 2016.

Below is gold overview from the report, to download a PDF copy of the full report covering all the metals in pdf form click here.

Subscribers have access to these reports before they are published through the research tab in FastMarkets Professional.

Gold – Expect the frenzied rally to slow

Summary

Gold continued to strengthen in the second quarter, rising 7.4 percent, although this was slower than the first-quarter pace of 11.3 percent, resulting in a solid net increase of 24.4 percent so far this year. The macro environment remained supportive in the second quarter due to elevated macro uncertainty and Fed dovishness. While gold could come under a little more upward pressure in this quarter because the Fed may remain cautious, supporting speculative and investor demand, we expect renewed weakness in the fourth quarter once US real interest rates start bottoming out due to a stronger US economic recovery.

Overall trend – Gold climbed 7.4 percent in the second quarter after rising 16 percent in the first quarter – it peaked at $1,359 per ounce in June, its highest since March 2014. The macro environment remained supportive in the second quarter as expected – elevated macro and political uncertainty boosted safe-haven demand, especially after the Brexit shock. Given the strong conviction in holding gold as a hedge against tail risk, it should remain supported in the third quarter, especially because a cautious Fed could prolong the decline in US real interest rates. But safe-haven demand should grow more slowly than in previous quarters and possibly reverse in the fourth quarter once macro fears diminish and the Fed resets market expectations about rates. We expect gold to range between $1,210 and $1,425 in the third quarter.

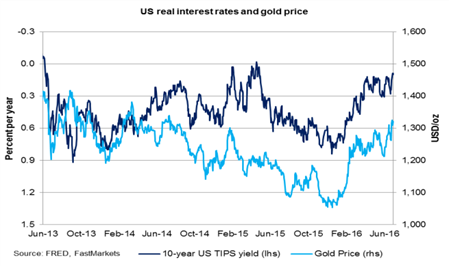

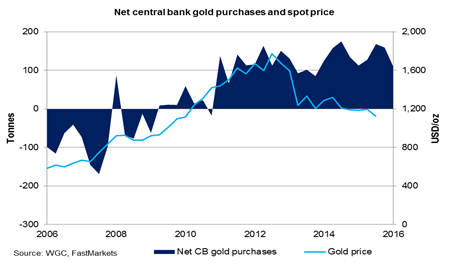

Speculators, investors, central banks drive rally – While investor and speculative demand on the one hand and central bank demand on the other have largely driven gold’s strong rise since the start of 2016, jewellery demand has weakened due to higher prices. Robust ETF investor/speculative demand, accounting for more than 25 percent of total demand, has been supported by the continued fall in US real interest rates, which itself reflects the probably shallower path of US rate rises amid disappointing data and growing downside risks stemming from weaker economic growth abroad. Central bank demand, accounting for 14 percent of total gold demand, has partly reflected their diversification strategy. The metal has become increasingly attractive in a negative-interest-rate world – a third of global government bonds are trading at a negative nominal yield. But jewellery demand, accounting for 56 percent of total gold demand, has fallen especially in China and India partly because of higher prices.

A little more upward pressure in Q3 – The Brexit could continue to hurt risk sentiment, partly due to knock-on effects to vulnerable domestic banking sectors such as Italy, as the widening spreads between core and periphery government bonds attest. China’s continued economic slowdown has put its banking sector in an increasingly weak position, raising the risk of contagion, as was the case at the start of the year. The macro environment threatens the US economic outlook amid uncertainty around the presidential election: while the Fed expected two rate increases for 2016 at its March meeting, recent political and economic events could stay its hand. If so, US real interest rates should continue lower in the third quarter but at a slower pace than in the first half, meaning speculative and investor conviction in holding gold should remain strong but grow more slowly. But higher gold prices should continue to hit jewellery demand, especially during the summer months. So gold could strengthen further, albeit slowly, in the third quarter.

Frenzy could end in Q4 – Despite uncertainty at the global macro level, we feel the US economy should remain resilient in the second half, with more slack to be taken up in the jobs market and inflation rising toward the Fed’s two-percent target. While the Fed may not recalibrate rate expectations in the near-term due to heightened post-Brexit uncertainty, macro data should remain with improving economic growth, which may prompt the Fed to get the ball rolling. This may be necessary: the market is currently pricing in a five-basis-point decline in the Fed funds rate by the end of 2016. In these circumstances, US real interest rates are likely to bottom out at some point in the fourth quarter, which should trigger some investment and speculative selling. Since gold ETF holdings and speculative net long positions on Comex have jumped in the year to date, selling pressure could induce a fast fall in gold prices later this year and early in 2017.

ETF holdings rose 214 tonnes in the second quarter to their highest since July 2013 after rising 320 tonnes in the first and a decline of 118 tonnes last year. We expect ETF investors to continue to buy gold in the third quarter, albeit at a slower pace.

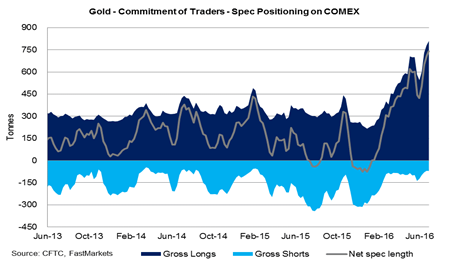

Money managers bought 303 tonnes on Comex in the second quarter after a record 514 tonnes in the first. Since speculative net long positions are at a record high, we expect slower buying in the third quarter and renewed selling in the final three months of 2016.

The negative correlation between gold prices and US real interest rates at 0.88 compares with -0.65 for 2015. Rates may fall further in third quarter on heightened uncertainty, boosting gold. But they could bottom out in the fourth quarter.

Central banks purchased 109.4 tonnes of gold in the first quarter, slightly down from 112.3 tonnes a year earlier. We expect central bank demand to remain steady in the coming quarters and years in light of their long-term diversification strategies.

The post Gold price forecast and analysis for Q3 2016 appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News