After some consolidation at the end of last week, further strength has returned to the base metals this week, with copper prices pushing the envelope on the upside, while the rest of the complex has also seen prices head back towards recent highs.

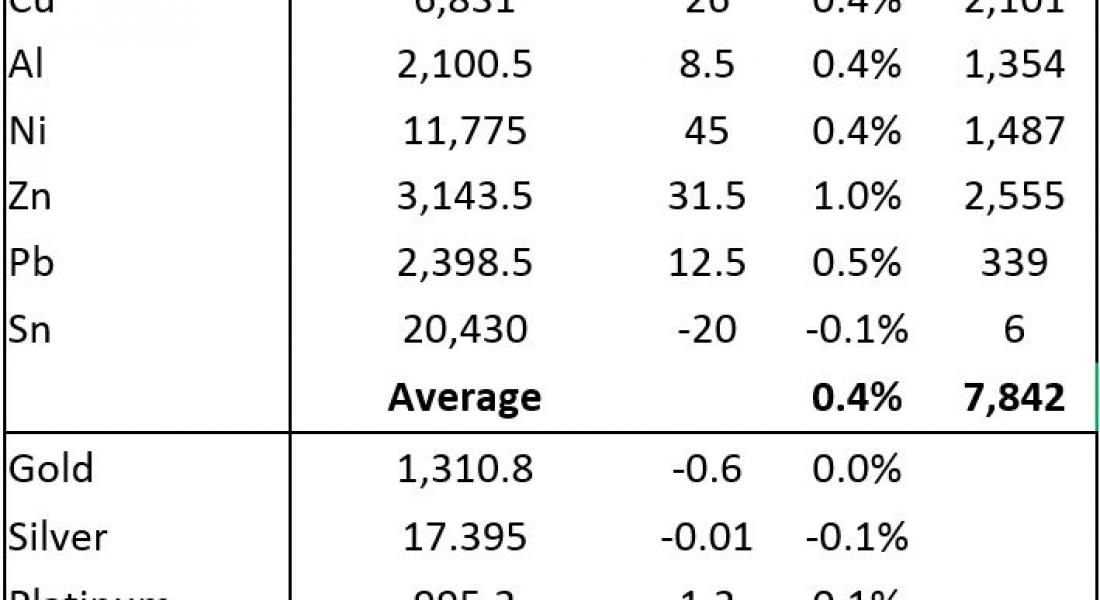

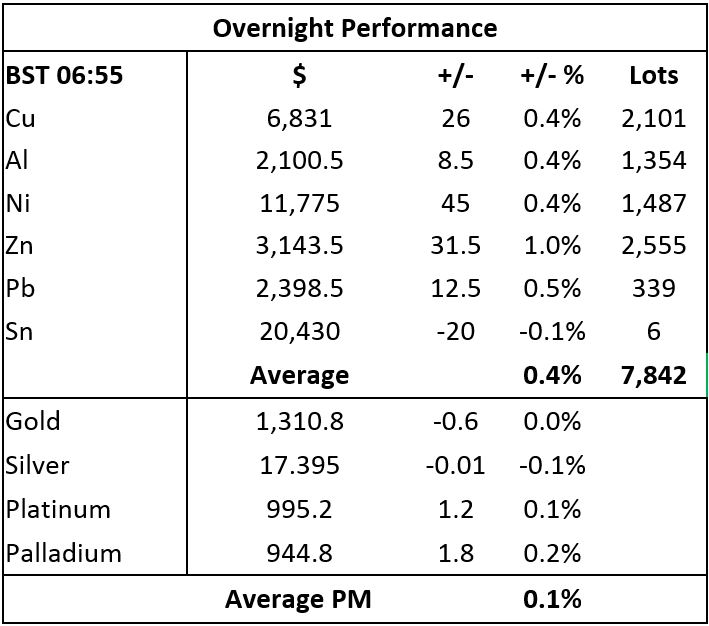

This morning, Wednesday August 30, base metals prices on the London Metal Exchange are up by an average of 0.4%, led by a 1% rise in zinc, while three-month copper prices are up 0.4% at $6,831 per tonne. Volume has been average with 7,842 lots traded as of 06:55 BST.

This morning’s continued strength follows a strong day on Tuesday when the complex closed up with average gains of 1.5%, led by a 2.6% gain in lead and a 2.3% rise in aluminium.

Precious metals prices are consolidating this morning after strong gains seen on Monday; gold and silver prices are little changed with spot gold at $1,310.80 per oz, while the PGMs are up by between 0.1% and 0.2%. This follows a day of price correction for bullion on Tuesday with gold and silver prices both down by 0.6%, while the PGMs were both up by 0.4%.

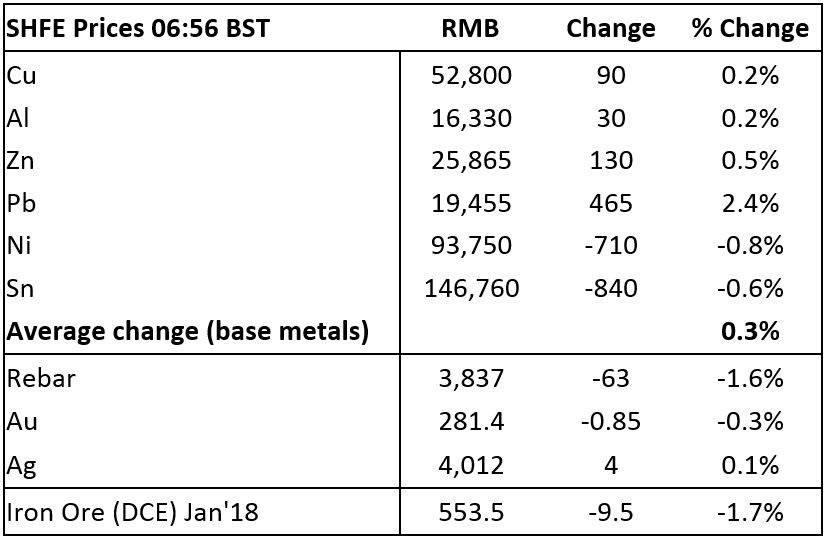

On the Shanghai Futures Exchange (SHFE) this morning, lead prices are in the driving seat with gains of 2.4%, copper, aluminium and zinc prices are up between by 0.2% and 0.5%, with copper at 52,800 yuan ($8,013) per tonne, while nickel prices are off by 0.8% and tin prices are down by 0.6%. Spot copper prices in Changjiang are off by 0.2% at 52,440-52,620 yuan per tonne and the LME/Shanghai copper arb ratio is weaker at 7.32.

Steel rebar prices on the Shanghai Futures Exchange are weaker, down by 1.6%, gold prices are off by 0.3% and silver prices are up by 0.1%, while January 2018 iron ore prices on the Dalian Commodity Exchange are down by 1.7% at 553.50 yuan per tonne.

In international markets, spot Brent crude oil prices are off 0.1% at $51.88 per barrel and the yield on US ten-year treasuries is weaker at 2.15% as is the German ten-year bund yield at 0.36% – both a sign that haven demand is strong, as indeed gold portrays.

Equities in Asia are mainly stronger this morning – gains are being seen on the Hang Seng (0.93%), the Nikkei (0.74%), the Kospi (0.22%), the CSI 300 (0.1%), while the ASX 200 is little changed. In the USA, the Dow Jones closed up 0.26% at 21,865.37 and in Europe, the Euro Stoxx 50 closed down 0.96% at 3,388.22.

The dollar index at 92.48 is rebounding after Tuesday’s drop to 91.62, the weakness on the back of falling bond yields, which in turn appear to be a factor of the impact of Hurricane Harvey and the escalation in tension over North Korea. Any rebound that gathers momentum could check the rallies in the metals. Conversely, the euro at 1.1955 has pulled back from Tuesday’s 1.2070 high, sterling at 1.2915 is under pressure again, the yen at 110.11 is weaker, while the Australian dollar at 0.7965 is stronger.

Emerging market currencies are for the most part flat, although the yuan is strong at 6.5911 – the strongest it has been since June 2016 – this suggests a vote of confidence in the economy and how the government is handling it.

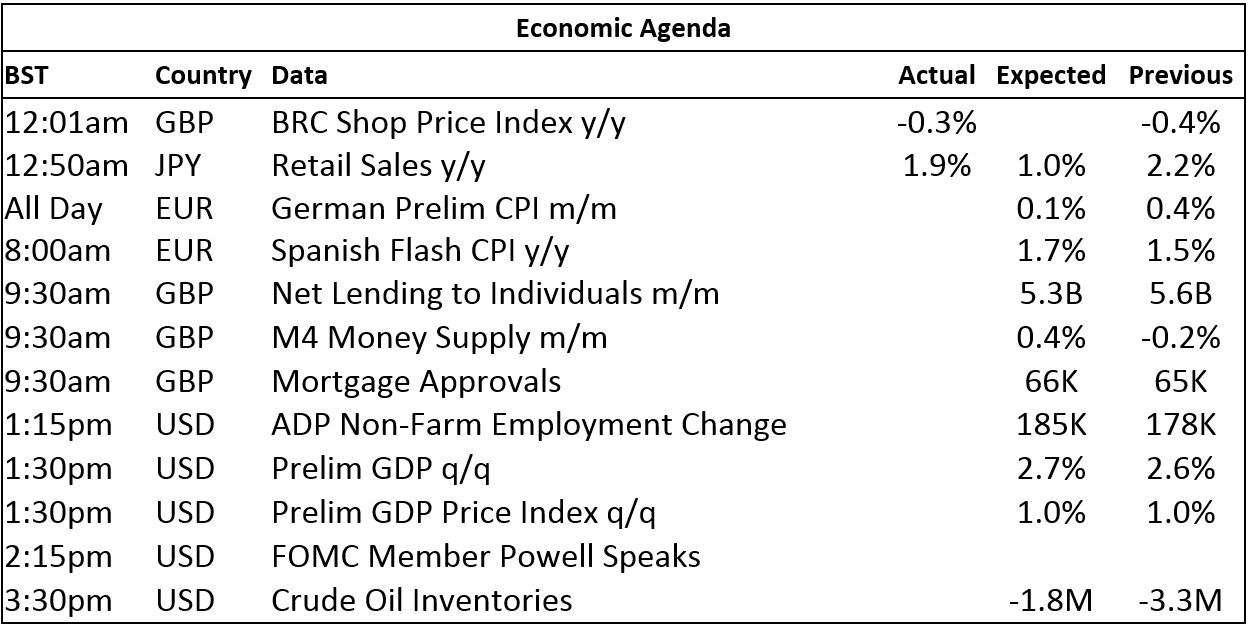

On the economic agenda, Japan’s retail sales growth dipped to 1.9%, after 2.2%, but it beat the expected 1%. Later there is data on German and Spanish CPI, UK data on lending, US ADP non-farm pay rolls, preliminary GDP, GDP prices and crude oil inventories. In addition, US Federal Open Market Committee member Jerome Powell is speaking.

Copper prices have had a strong run to the upside and although we remain bullish, the current up leg is looking quite stretched now, so some consolidation seems likely, especially if the dollar rebounds. The rest of the metals have been consolidating in high ground for some time, so they may be ready to push higher and catch up with copper’s lead. Although all prices, with the possible exception of tin, are in high ground so we should expect scale-up forward selling and profiting-taking to make the upside going more of a struggle. This in turn increases the risk of corrections – key will be how well the dips are supported. On balance, we remain bullish for the base metals complex, but would not be surprised to see some consolidation.

Gold prices had been challenging the high ground below $1,300 per oz but had struggled to break higher, but the escalation in tension over North Korea provided the catalyst and the break higher looks bullish medium term. Short term there may need to be some consolidation and perhaps a test of the breakout level around $1,300 per oz. Silver is following gold’s lead, but is not looking as bullish, palladium prices continue to look stronger, but prices are already very high, while platinum prices are looking stronger and remain relatively weak to those of gold and palladium.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Base metals prices edge up in high ground appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News