Precious metals prices are little changed this morning, with spot gold prices down by 0.2% at $1,287.90, this after a firmer day on Monday when precious metals prices were pushed higher by a combination of stronger industrial metals and heightened geopolitical concerns over the USA and North Korea.

Precious metals are for the most part bullish, gold prices are holding up in high ground underpinned by geopolitical concerns focused on North Korea, while palladium’s supply shortage is keeping prices firm and platinum prices are following gold’s lead.

Base metals traded on the London Metal Exchange are for the most part consolidating this morning, Tuesday August 22, after a generally strong performance on Monday when the complex closed up by an average of 1%.

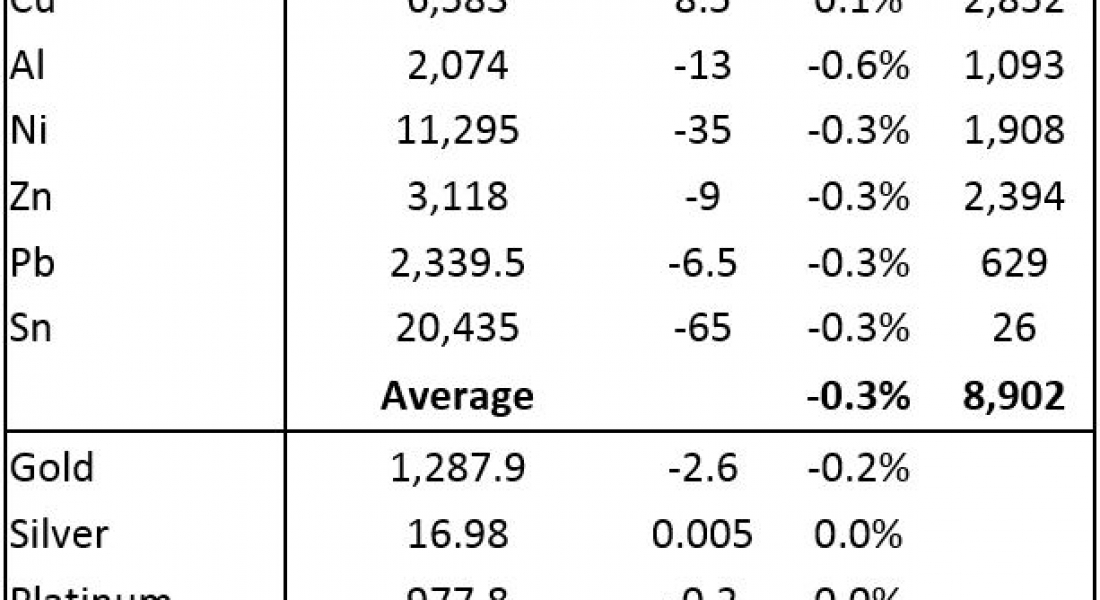

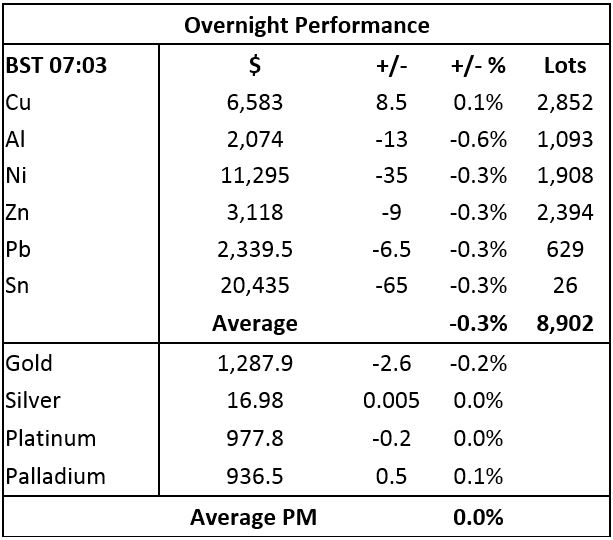

This morning, three-month copper prices are up by 0.1% at $6,583 per tonne, while the rest of the complex is down by an average of 0.4%, led by a 0.6% fall in aluminium prices to $2,074 per tonne, while the rest are all off by 0.3%. Volume has been average with 8,902 lots traded as of 07:03 BST

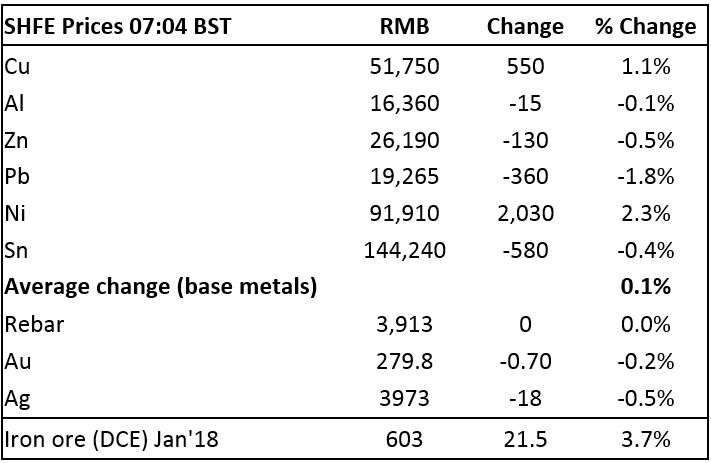

On the Shanghai Futures Exchange (SHFE) this morning, the base metals complex is quite mixed as nickel plays catch up with Monday’s LME performance, with prices up by 2.3%, while copper prices are up by 1.1% at 51,750 yuan ($7,776) per tonne and lead prices are off by 1.8%.

Spot copper prices in Changjiang are up by 0.9% at 51,300-51,500 yuan per tonne and the LME/Shanghai copper arb ratio stands at 7.86 (compared with 7.85 on Monday).

In other metals in China, SHFE rebar prices are little changed, gold prices are off by 0.2% and silver prices are off by 0.5%, while on the Dalian Commodity Exchange (DCE), January 2018 iron ore prices are up by 3.7% at 603 yuan per tonne.

In international markets, spot Brent crude oil prices are up by 0.4% at $51.91 per barrel, the yield on US ten-year treasuries is at 2.20%, and the German ten-year bund yield is at 0.41%

Equities are for the most part stronger today – the Hong Kong Hang Seng Index (+1.1%), the ASX 200 (+0.4%), the Kospi (0.4%), the CSI 300 (0.3%) are higher, while the Nikkei (-0.1%) is down slightly. In the USA, the Dow Jones closed up 0.13% at 21,703.75 and in Europe, the Euro Stoxx 50 closed up 0.65% at 3,423.53.

The dollar index is weaker this morning at 93.26 and most of the majors are consolidating with sterling at 1.2877, the euro at 1.1794 and the yen at 109.29, although the Australian dollar is firmer at 0.7942, helped by the stronger commodity prices.

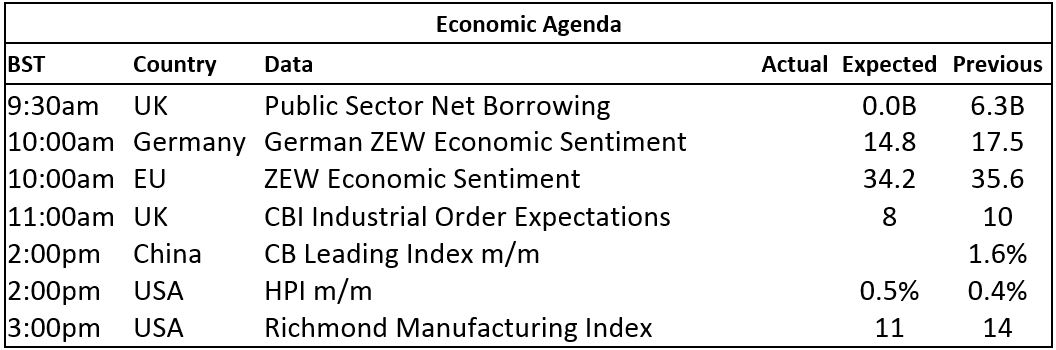

On the economic front there is data on German and EU ZEW economic sentiment, UK CBI industrial orders, China’s leading indicators and the USA’s house price index and Richmond Manufacturing index. Looking ahead, investors will continue to scrutinise the political developments in the USA to make their investment decisions and will likely start to turn their attention to the speeches of central bank officials at the Jackson Hole Economic Symposium (August 24-26), including European Central Bank president Mario Draghi and US Federal Reserve chair Janet Yellen on August 26.

For the most part, the base metals prices continue to look bullish, some more so than others with tin and to a lesser extent lead the mains ones struggling, or more likely to run into forward selling, while forward selling seems less of an issue for the other base metals. On balance, we remain bullish for the base metals complex and expect dips to find good underlying support.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices holding up in higher ground underpinned by geopolitical tensions appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News