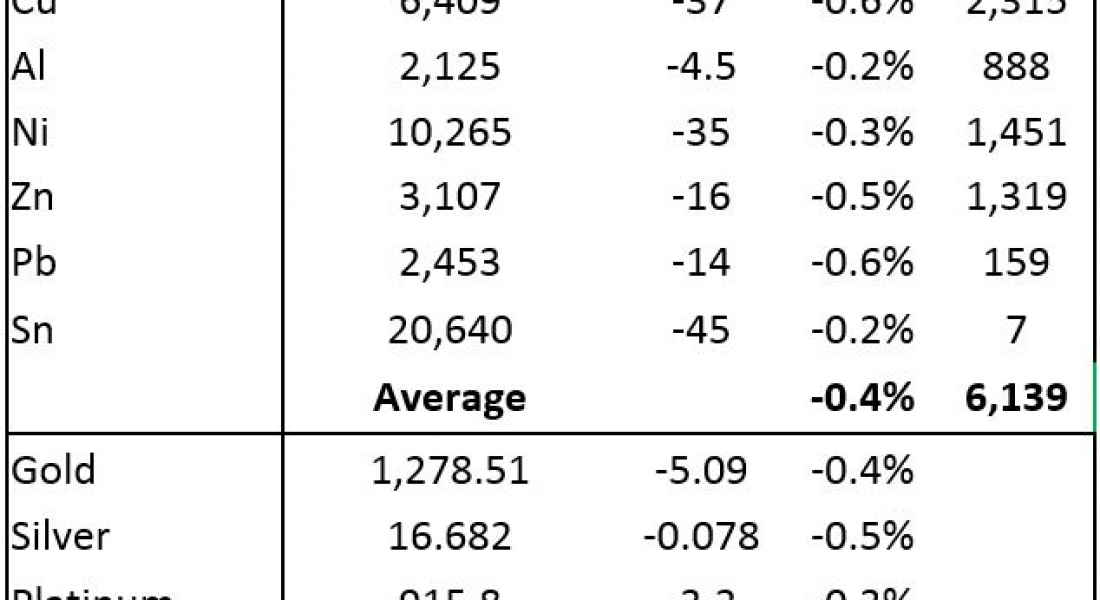

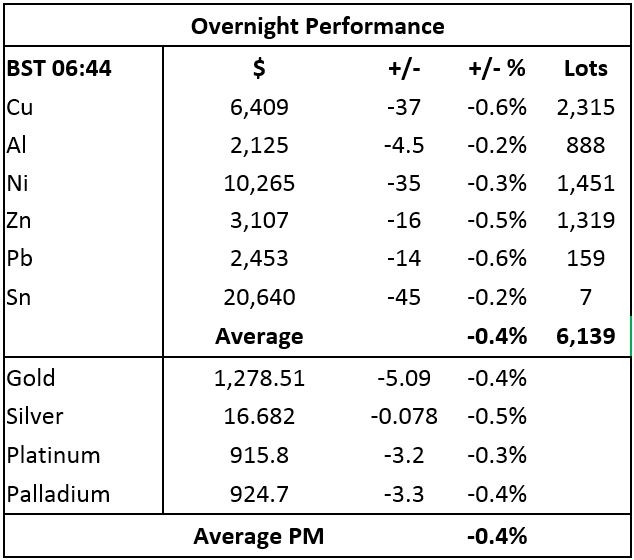

Base metals prices are down across the board by an average of 0.4% on the London Metal Exchange this morning, Thursday September 28. Volume has been average with 6,139 lots traded as of 06:44 BST.

This after a varied performance on Wednesday that saw further losses in nickel (-1.4%) and lead (-0.7%), while the rest were up between little changed for tin prices and 0.3% for aluminium and zinc prices.

Precious metals prices are down between 0.3% and 0.5% this morning, with spot gold prices off 0.4% at $1,278.51 per oz. This after a generally weak day on Wednesday when gold prices closed off 0.8%, silver was 0.3% weaker, platinum prices were down 0.4%, while palladium prices bucked the trend with a 1.5% rebound to $928 per oz.

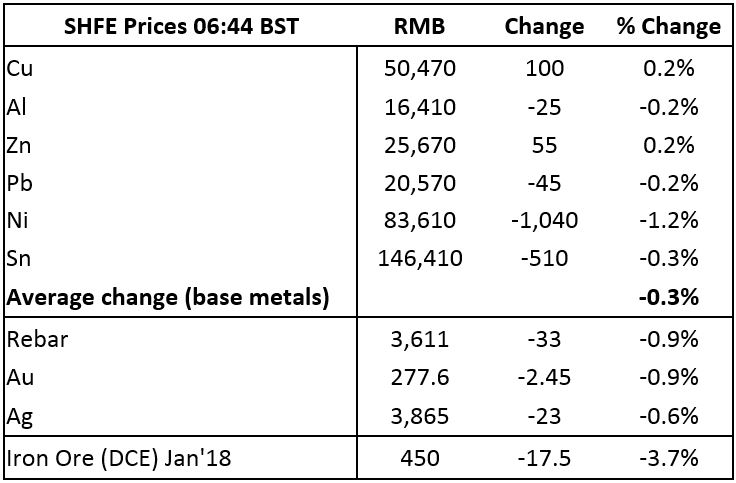

On the Shanghai Futures Exchange (SHFE) this morning, copper and zinc prices are up by 0.2%, with copper at 50,470 yuan ($7,600) per tonne, while the rest are weaker. Nickel prices lead on the downside with a 1.2% fall, followed by tin prices, down 0.3%, and aluminium and lead prices which are down by 0.2%.

Spot copper prices in Changjiang are up 0.2% at 50,360-50,680 yuan per tonne and the London/Shanghai copper arb ratio has pushed higher to 7.88, from 7.79 on Wednesday, indicating LME copper prices have fallen more than SHFE prices.

Iron ore and steel rebar prices in China continue to weaken, with January iron ore prices down 3.7% this morning at 450 yuan per tonne on the Dalian Commodity Exchange, while SHFE steel rebar prices are down 0.9%. Gold and silver prices on the SHFE are down by 0.9% and 0.6%, respectively.

In international markets, spot Brent crude oil prices are up by 0.12% at $57.71 per barrel and the US tax cut plans have seen on US ten-year treasuries jump, with the yield rising to 2.35%, compared with 2.26% around this time on Wednesday. The German ten-year bund yield has firmed to 0.47%.

Asian equities are for the most part positive this morning, led by a 0.5% gain on the Nikkei, which is being helped by the weaker yen; the ASX 200 and Kospi are up 0.1%; while the CSI 300 is little changed and the Hang Seng is down 0.2%. This follows a firmer session on Wednesday, where in the USA, the Dow closed up 0.25% at 22,340.71, while in Europe, the Euro Stoxx 50 closed up 0.53% to 3,555.17.

The dollar’s rise continues with the dollar index at 93.56, with the market more confident that the US Federal Reserve will raise rates in December and relieved that US president Donald Trump may finally be getting traction on some of his election promises. As the dollar strengthens, other currencies are on a back footing with the euro at 1.1736, sterling at 1.3337, the yen at 113.02 and the Australian dollar at 0.7822.

The Chinese yuan is losing value rapidly, it was recently quoted at 6.6661, having been as strong as 6.4345 on September 8, and the emerging currencies we follow are falling too.

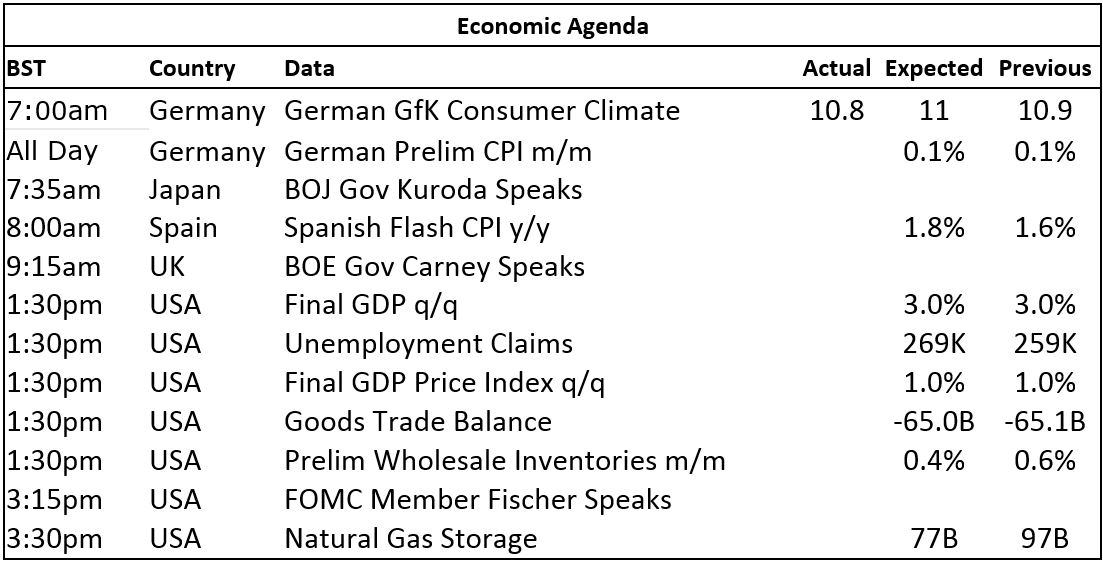

German Gfk consumer climate edged lower to 10.8 from 10.9, later there is data out on German CPI, Spanish CPI, with US data including GDP, GDP prices, initial jobless claims, goods trade balance, wholesale inventories and natural gas storage. In addition, various central bankers are speaking, including Bank of Japan governor Haruhiko Kuroda, Bank of England governor Mark Carney and US Federal Open Market Committee member Stanley Fischer.

The base metals remain in correction and consolidation mode as we approach the end of the quarter and the weakness does feel like profit-taking after strong rallies were seen over the summer. China’s National Day Golden Week holiday also kicks-off next week, so there may well be some book squaring ahead of that. Generally, we do see this weakness as consolidation within up trends – we would let the pullbacks run their course before looking for buying opportunities.

Gold prices remain under pressure as the market seems to have become tired of the ongoing rhetoric but lack of progress over North Korea. In addition, the stronger dollar is proving to be a negative for gold prices and may well be prompting stale long liquidation. We expect the North Korean saga to lead to scale-down buying. Silver and platinum prices are following gold’s lead, while the weaker palladium prices of late seem to be attracting dip buying.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Gold prices slide as dollar rebounds appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News