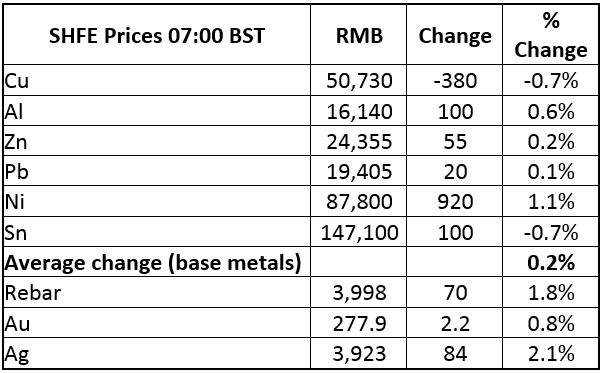

The precious metals are firmer, up by a net 0.3%, led by increases in silver and PGM prices as rising tensions between the USA and North Korea prompt a modest short-covering rally.

Precious metals may continue to push higher in the days ahead if US/North Korea tensions escalate. Markets will also be sensitive to shifting expectations in Fed monetary policy, particularly if tomorrow’s CPI figures fail to reflect the pick-up in inflation currently forecast.

The metals complex continues to carry positive momentum, even as rising geopolitical tensions trigger a modest correction in global equity markets after the Dow Jones Industrial Average closed in lower for a third consecutive day. Sabre rattling between Pyongyang and Washington continues after North Korean state media reported authorities are working on plans to fire four missiles near the US territory of Guam, which will be ready by mid-August.

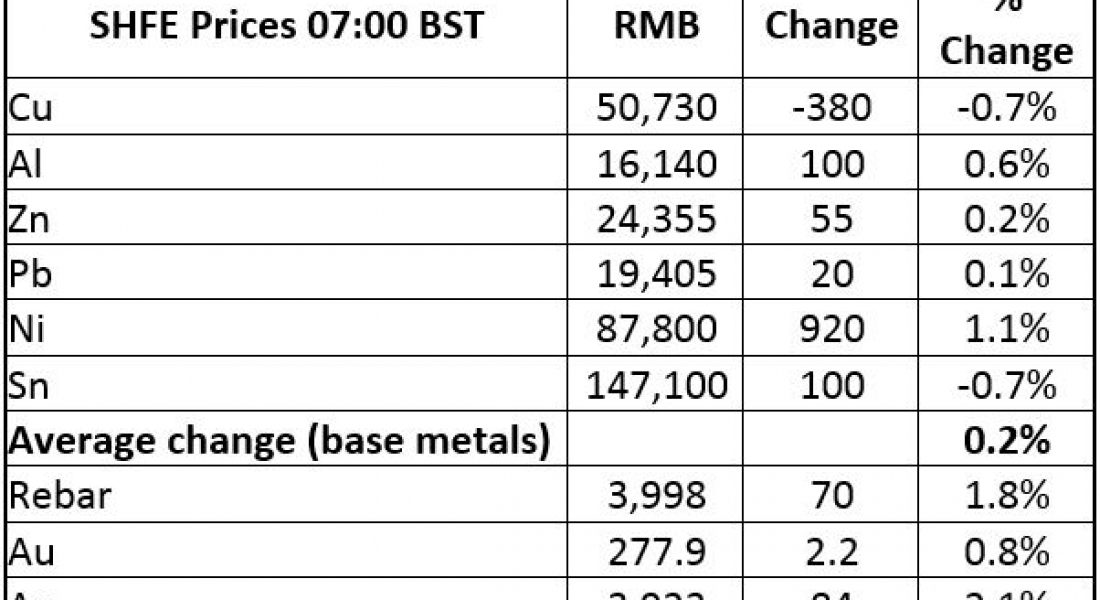

The base metals traded on the London Metal Exchange were up a net 0.4% on the back of modest volume; a total of 8,320 lots had traded on Select as of 07:00 BST. Lead (1%) is leading the advance so far today, followed by tin (0.9%) and nickel (0.5%). Meanwhile copper was little changed as prices consolidate recent gains.

Equities are under slight selling pressure this morning, adding to the soft close to the US market. The CSI 300 was down 0.6% at the time of writing while Nikkei 225 was marginally lower (-0.1%), after data from Japan showed core machinery orders disappointed, contracting by 1.9% for a third consecutive month.

In other markets oil prices have stabilised ahead of $50 per barrel after US oil inventories recorded a larger-than-forecast 6.5 million barrel drop last week. The dollar index currently stands at 93.69, although still above its recent low of 92.84 on August 3. The Japanese yen has found some haven bids.

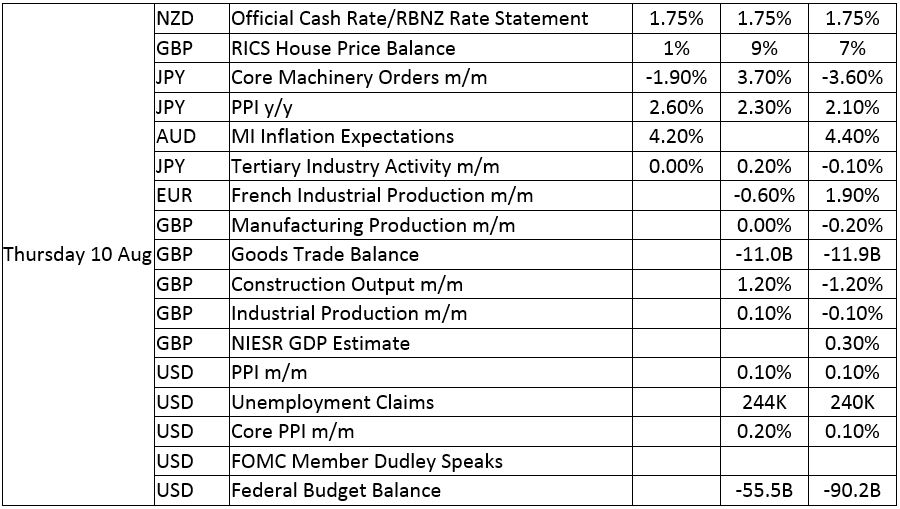

Overnight the Reserve Bank of New Zealand held its base interest-rate at a record low of 1.75%; Governor Graeme Wheeler reiterated that policy would stay loose for a considerable time to come.

The macroeconomic agenda is busier today and includes UK construction and industrial output for June, French industrial production and weekly jobless claims from the USA. Markets will also be watching comments from Federal Reserve Bank of New York President and Federal Open Market Committee number-two William Dudley ahead of US consumer price index (CPI) inflation data tomorrow.

Fundamental developments will continue to provide underlying price support to the base metals, although the soft tone in equities and rising geopolitical tension could create headwinds for price, and an element of profit taking is unsurprising given the scale of recent gains.

Precious metals may continue to push higher in the days ahead if US/North Korea tensions escalate. Markets will also be sensitive to shifting expectations in Fed monetary policy, particularly if tomorrow’s CPI figures fail to reflect the pick-up in inflation currently forecast.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post METALS MORNING VIEW: Metals prices remain upbeat, even as geopolitical tensions pick up appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News