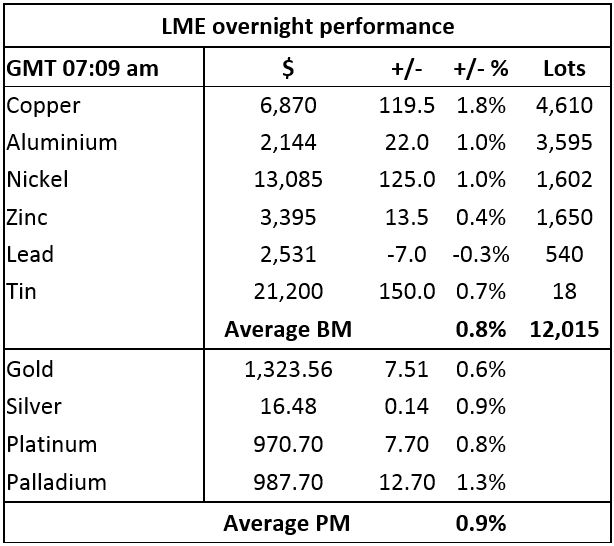

The precious metals are also firmer this morning after experiencing broad-based weakness last week – prices are up by an average of 0.9%, led by a 1.3% rise in palladium prices, with gold prices up the least with a 0.6% rise to $1,323.56 per oz.

Precious metals sold off in line with the other metals and markets highlighting risk–off, if weakness continues to be seen in other markets then there may well be some rotation out of equities and bonds into gold as a haven.

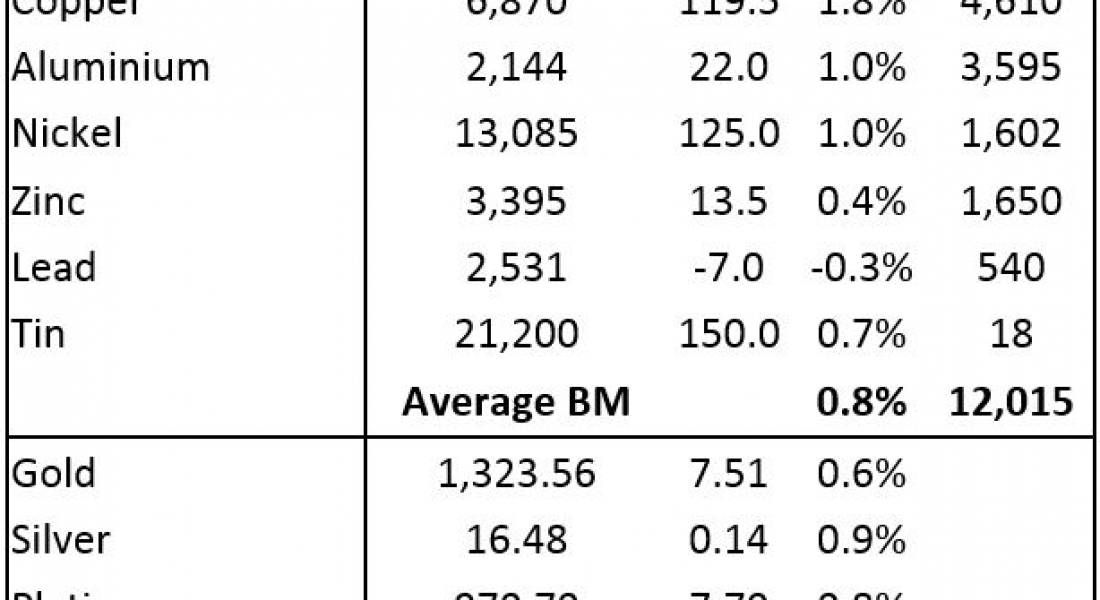

Base metals prices on the London Metal Exchange seem to have found buying interest this morning, Monday February 12, with all of the base metals, except lead (-0.3%), showing gains averaging 1%. The three-month copper price leads the way with a 1.8% rally to $6,870 per tonne – this after a low last Friday of $6,733 per tonne.

Volume has been high with 12,015 lots traded as of 07:09 am London time – the question now being whether last week’s risk-off sentiment has run its course. At the lows on Friday, the base metals prices were down from their recent highs by an average of 7.2%, ranged between a 9.2% fall in nickel prices and a 4.6% fall in tin prices.

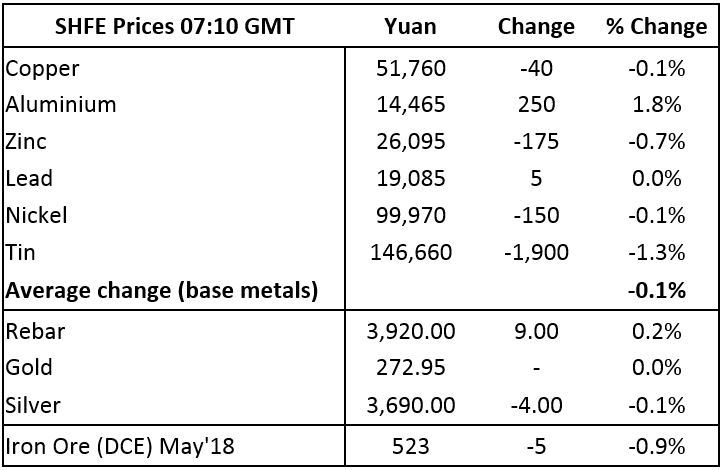

On the Shanghai Futures Exchange, the base metals are mixed this morning – at the extremes, aluminium prices are up by 1.8% and tin prices are down by 1.3%, copper, lead and nickel prices are little changed and zinc prices are off by 0.7%. Copper prices are at 51,760 yuan ($8,222) per tonne, while spot copper prices in Changjiang are down by 0.2% at 51,130-51,290 yuan per tonne and the LME/Shanghai copper arbitrage ratio stands at 7.54, down slightly from 7.53 on Friday.

In other metals in China, iron ore prices are down by 0.9% at 523 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are up by 0.2%, while gold prices are unchanged and silver prices are down by 0.1%.

In wider markets, spot Brent crude oil prices are rebounding, up by 1.27% at $63.37 per barrel, while the yield on US 10-year treasuries is strong at 2.87%, as is the German 10-year bund yield at 0.78%.

Equities in Asia are for the most part rebounding today: Nikkei (closed), Kospi (+0.90%), CSI 300 (+1.29%), Hang Seng (+0.64%), although the ASX 200 is down 0.30%. This follows a mixed performance in western markets on Friday, where in the United States the Dow Jones closed up by 1.38% at 24,190.90, and in Europe where the Euro Stoxx 50 closed down by 1.52% at 3,325.99.

The dollar index is consolidating after last week’s rebound, it was recently quoted at 90.18, the low being 88.43 on January 25. The euro and sterling are weaker at 1.2277 and 1.3846 respectively, while the yen (108.61) is consolidating after recent strength and the Australian dollar (0.7817) is consolidating after two weeks of weakness. The yuan at 6.3119 is also off recent highs, while the other emerging currencies we follow are consolidating after recent weakness.

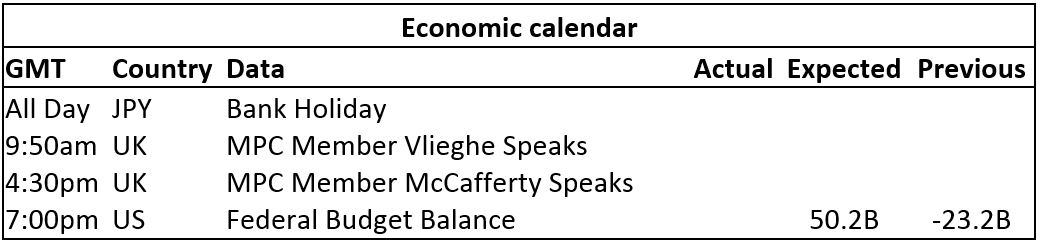

The economic agenda is light today with data on the US Federal budget balance – in addition, Bank of England Monetary Policy Committee members Gertjan Vlieghe and Ian McCafferty are speaking.

All eyes are on whether the global sell-off last week has run its course and with the Lunar New Year also getting underway this week, trading is likely to remain nervous and choppy. Underlying sentiment seems to be bullish but having had a shake-out last week, overhead resistance is likely to be even stronger now while the market adjusts to the increased volatility. We should get an update on how bullish sentiment is by seeing how well the dips are supported and the level of follow through buying.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Metals morning view: Precious metal prices firmer after broad-based weaknesses appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News