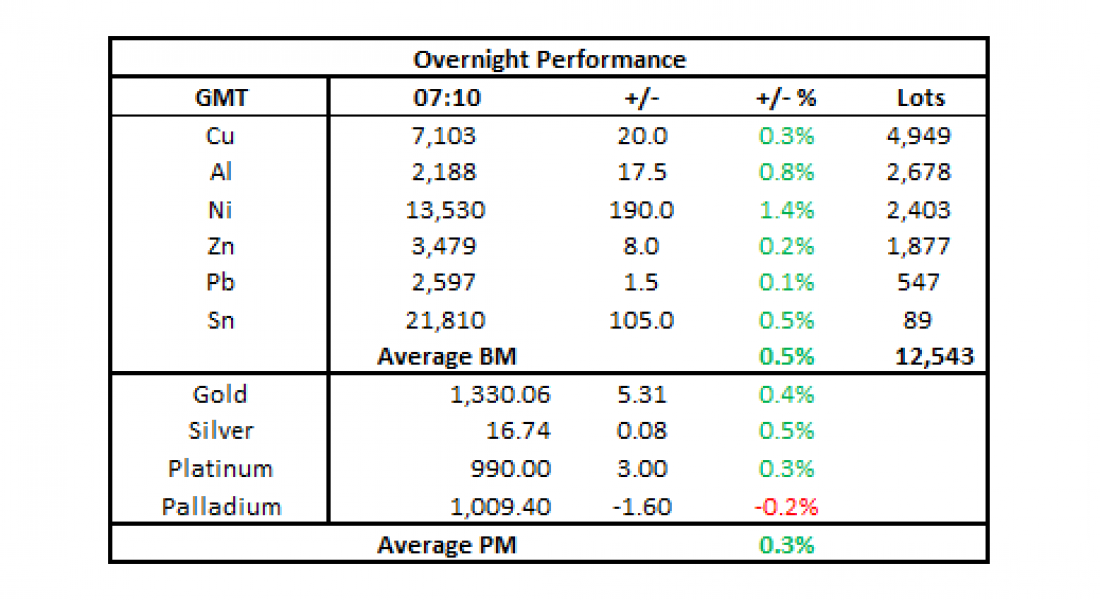

Looking at the precious metals, the complex is slightly bid this morning, posting an average gain of 0.3%. This reflects a friendly macro backdrop in which the dollar and US real rates are moving lower, thereby prompting some speculative buying. Since investors are “risk-off” today, palladium continues to be the laggard of its complex, down by 0.2% and the only precious metal in negative territory. This comes after an overall weak performance on Tuesday when the complex posted an average loss of 0.6%, as the stabilization in the financial markets (lower VIX, stronger equities), dampened any haven bids.

Precious metals may continue to experience upward pressure in the immediate term amid a friendly macro backdrop for the complex. We favor gold due to its higher sensitivity to the fluctuations in the dollar and US real rates. We are the most cautious toward palladium as “risk-off” episodes cannot be ruled out after the panic on Monday.

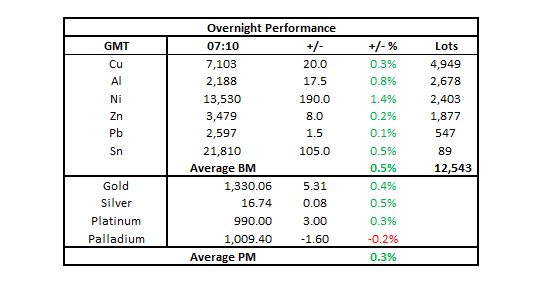

Base metals traded on the London Metal Exchange are ticking higher this morning, Wednesday February 4, posting an average gain of 0.6%. Nickel (+1.4%) is the strongest, while zinc (+0.2%) and lead (+0.1%) are the laggards of the complex.

Volume has been healthy with 12,543 lots traded as of 07.10 am London time.

The resurgence of upward pressure in industrial metals comes after a stabilization in the financial markets on Tuesday following a panic at the start of the week. The CBOE volatility index (VIX) reached a high of 38.80 on Monday before falling back to around 30, which is still a high level judging by historical measures.

This morning, there is some nervousness in risk assets, with broad equities in Asia under downward pressure. But base metals remain bid, probably thanks to the renewed weakness in the dollar. The dollar index – at 89.54 at the time of writing – is down slightly for the first time in three days. Since yesterday’s weakness in the industrial metals was predominantly driven by fresh selling (judging by the increase in open interest), we are inclined to think that some short-covering is now at play this morning.

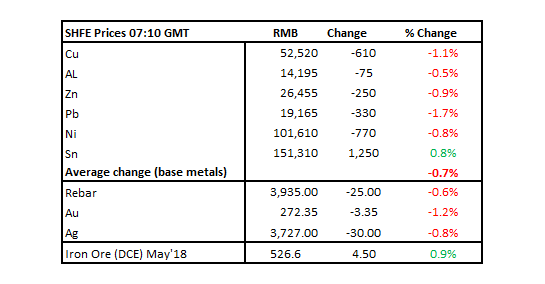

On the Shanghai Futures Exchange, however, the base metals complex remain under downward pressure, showing an average loss of 0.7%, reinforcing our view that the strength in the LME base metals complex is driven by the foreign exchange channel. Lead (-1.7%) is the worst performer, while tin (+0.8%) is still the strongest, being the only base metal in positive territory. Copper prices in Changjiang are up by 0.3% at 52,690-52,870 yuan ($8,382-8,411) per tonne and the LME/Shanghai copper arb ratio stands at 7.39, down from 7.47 yesterday.

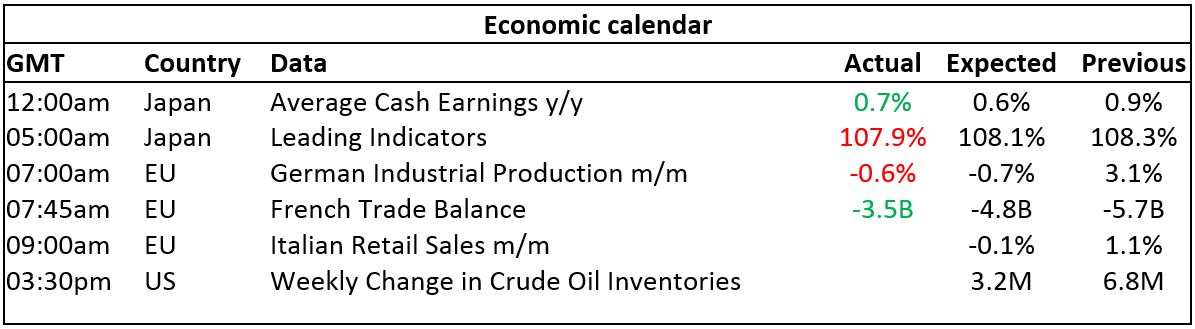

On the macro front, investors will pay close attention to US Federal Reserve speeches, with William Dudley (New York), Charles Evans (Chicago), and Robert Kaplan (Dallas) due to speak. Any interpretation regarding the recent market turbulence will be scrutinized by market players, which could in turn lead to a change in market expectations about the Fed tightening cycle. Any resulting effect on global risk appetite and the dollar could produce spillover effects on the industrial metals. Today’s macro data releases can be seen in the table at the very end of the report.

Base metals should enjoy some short-covering after the recent market turbulence proved only transitory. We favor zinc and lead because they were hit the most at the start of the year, precisely due to their stretched spec positioning. Their supportive micro dynamics should prompt financial players to buy the dips.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Metals morning view: Precious metals may continue to experience upward pressure appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News