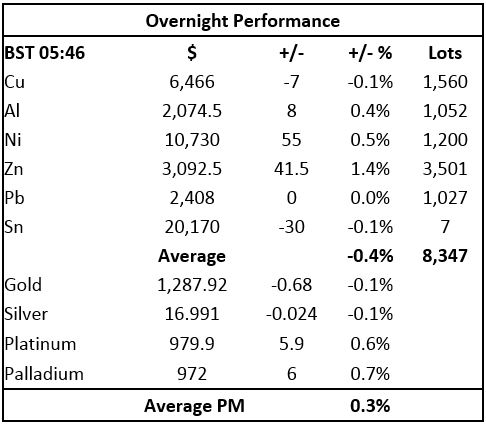

Precious metals prices are mixed this morning, with gold (-0.1%) and silver (-0.1%) down and the PGMs up, in spite of a weaker dollar, which should in theory push the entire complex higher.

This follows a mixed session on Thursday in which gold strengthened a little while the rest of the complex was under downward pressure in spite of a friendlier macro backdrop (ie lower US real rates, equity losses) due to the release of dovish US Federal Open Market Committee minutes on Wednesday and dovish Fed speech yesterday.

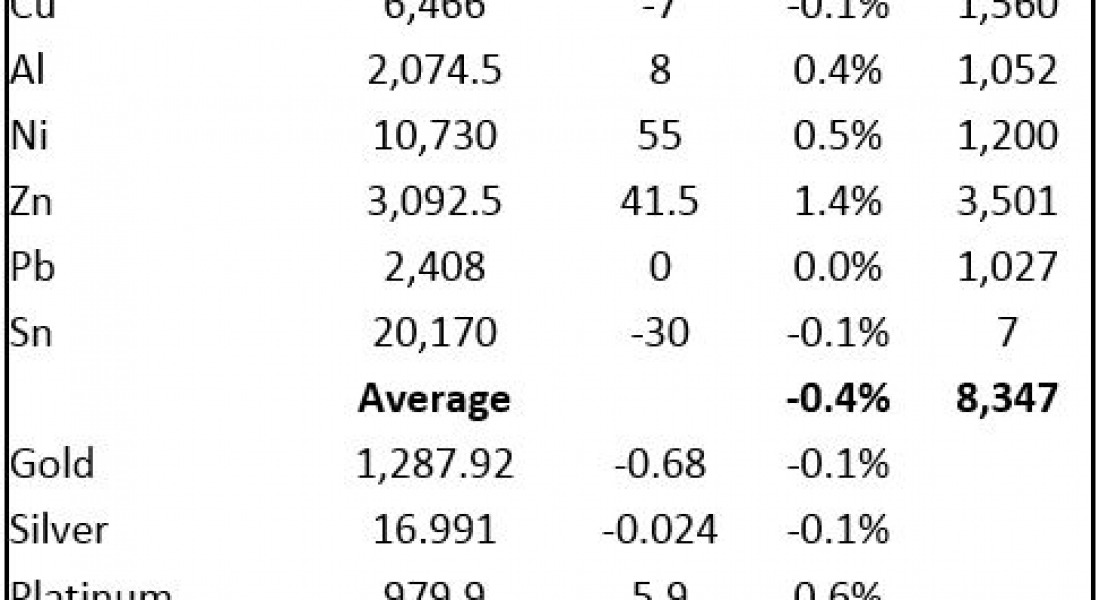

Base metals traded on the London Metal Exchange are ticking higher this morning, Friday August 18, which could reflect some tactical short-covering ahead of the weekend in spite of a return to risk-off mode, evidenced in losses across Asian equities and the appreciation in funding currencies such as the yen. Zinc (+1.4%) is the strongest performer while copper (-0.1%) and tin (-0.1%) are the laggards of the complex. Volume has been average with 8,347 lots traded as of 05:46 BST.

This comes after a weak session on Thursday, with the London Metal Exchange Index (LMEX) closing down 0.9%, reflecting some tactical profit-taking after strong gains registered on Wednesday, exacerbated by a sudden rise in risk aversion caused by heightened political uncertainty in the USA.

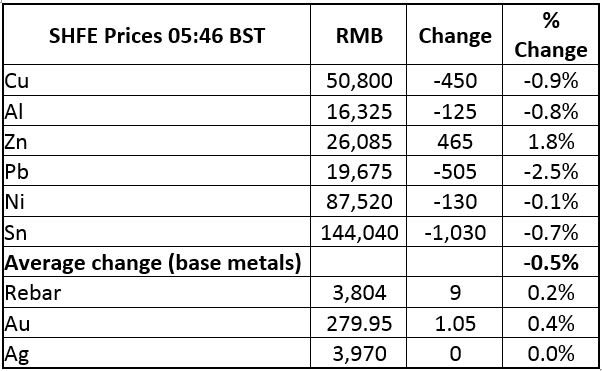

On the Shanghai Futures Exchange (SHFE) this morning, the base metals complex is under slight downward pressure, showing a small average loss of 0.5% as we write. Lead (-2.5%) is hit the most while zinc (+1.8%) is the only base metal in positive territory. Spot copper prices in Changjiang are up 1.5% at 50,450-50,570 yuan per tonne and the LME/Shanghai copper arb ratio stands at 7.86 (compared with 7.84 at the start of the week).

Equities are softer today, with the Nikkei 225 (-1.35%), the Hong Kong Hang Seng Index (-0.71%), the KOSPI index (-0.18%), and the CSI 300 index (-0.16%) all lower after a broad-based sell-off on Thursday. Most notably in the USA, the VIX (fear index) surged 32% to close at 15.55 on Thursday, triggered by rumours (albeit strongly denied by the White House) that US economic advisor Cohn would resign from his position.

The dollar index is little changed (-0.03%) at 93.59 this morning after strengthening somewhat on Thursday. The appreciation in the dollar was caused primarily by a fall in the euro following the dovish European Central Bank minutes, highlighting concerns about the risk of the euro “overshooting in the future”.

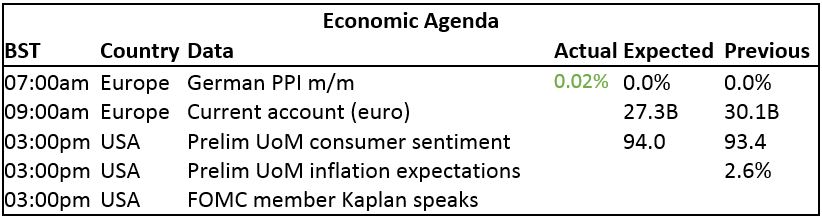

Looking at the day ahead, the economic agenda will be relatively light today. In Europe, investors will watch German PPI for July and the current account for June. In the USA, investors will monitor the Prelim UoM consumer sentiment and inflation expectations for August. Given the quiet macroeconomic data flow today, market players are likely to pay more attention to US politics and geopolitical developments to position their portfolios.

Base metals may experience some weakness today should the return to risk aversion continue and force eventually market players to cut exposure to the industrial metals following explosive gains earlier in the week. This would be consistent with the quiet physical market due to the low seasonal demand in the summer months. But given the overall positive sentiment toward the base metals, we expect dips to be bought.

Precious metals may catch some bid today because the market stress seen on Thursday was in our view a clear signal that the period of risk aversion, which started initially last week, was not complete. This should produce a fairly sweet environment for the complex (weaker dollar, lower US real rates), pushing prices higher. We would prefer gold and platinum over silver and palladium in a risk-off environment.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Precious metals are mixed in spite of weak dollar appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News