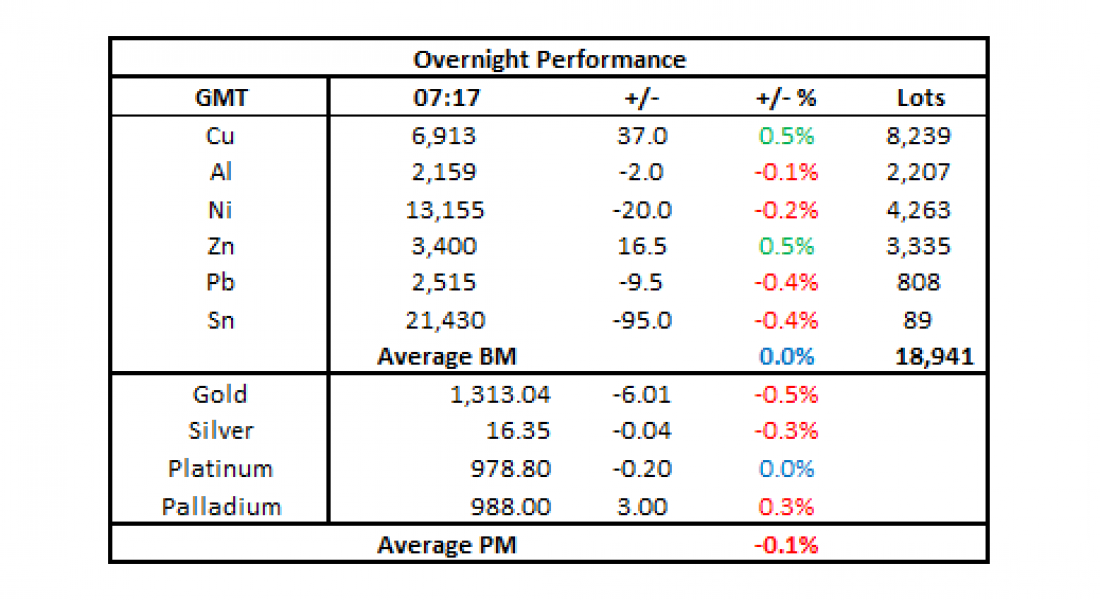

The precious metals complex is little changed this morning, posting an average loss of 0.1%, after a drop of 1.3% on Wednesday. In spite of wild swings in the CBOE Volatility Index (proxy for risk aversion), the complex has failed to capture meaningful haven bids, principally because investors seem to view the recent market turbulence as transient and as such, do not feel the need to revise their asset allocations. Precious metals demand is also undermined by dollar strength and higher US real rates, the two key macro variables of the complex. Given the prompt return to “normality”, palladium could perform the best thanks to its stronger sensitivity to cyclical assets.

Precious metals could come under downward pressure in the immediate term should the worst be over. It seems that investors are inclined to buy the dips as far as risky assets are concerned. This should dampen further haven demand but what will matter the most is the fluctuations of the dollar and US real rates. In this context, palladium could turn out to perform the best in light of its higher sensitivity to risk assets.

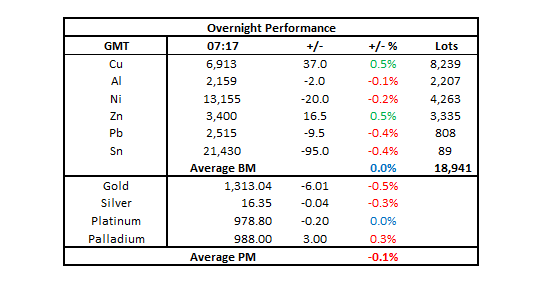

Base metals traded on the London Metal Exchange are little changed this morning, Thursday February 8, with copper (+0.5%) and zinc (+0.5%) the only metals in positive territory, while the rest are under slight downward pressure.

Volume remains healthy, however, with 18,941 lots traded as of 07.16 am London time.

The base metals complex seems to be undermined by a more pronounced appreciation in the dollar – the dollar index (at 90.37 at the time of writing) is now up for the fifth day in a row, compared with a recent low of 88.55 earlier in February.

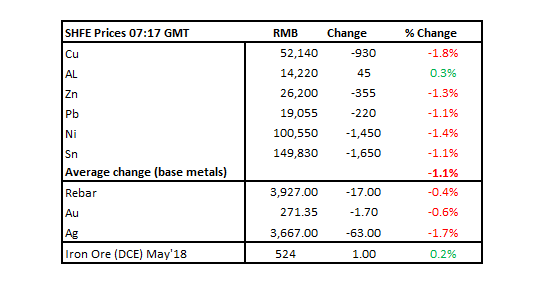

Of note, the dollar is strengthening substantially against the yuan this morning, with the dollar yuan rate up 0.88, the largest daily increase since August 12, 2015 (when the yuan shifted to a free floating exchange rate system). The notable depreciation in the yuan is likely to deteriorate further arbitrage opportunities, thereby dampening domestic demand for metals.

This morning’s weakness in the base metals comes after a weak trading session on Wednesday, with the complex posting an average loss of 1.8%, dragged lower by copper (-2.9%), lead (-2.8%) and zinc (-2.5%), which probably reflected negative spillovers from the stronger dollar and the weaker oil price, notwithstanding a decline in global risk aversion.

On the Shanghai Futures Exchange, the base metals are experiencing more pronounced downward pressure, showing an average loss of 1.1%, with copper (-1.8%) the worst performer and aluminium (+0.3%) the only metal posting a gain. The underperformance of SHFE prices versus LME prices is mainly driven by the foreign exchange channel, in our view. Copper prices in Changjiang are down by 2.2% at 51,510-51,690 yuan ($8,219-8,247) per tonne and the LME/Shanghai copper arbitrage ratio is at 7.54, up from 7.39 yesterday.

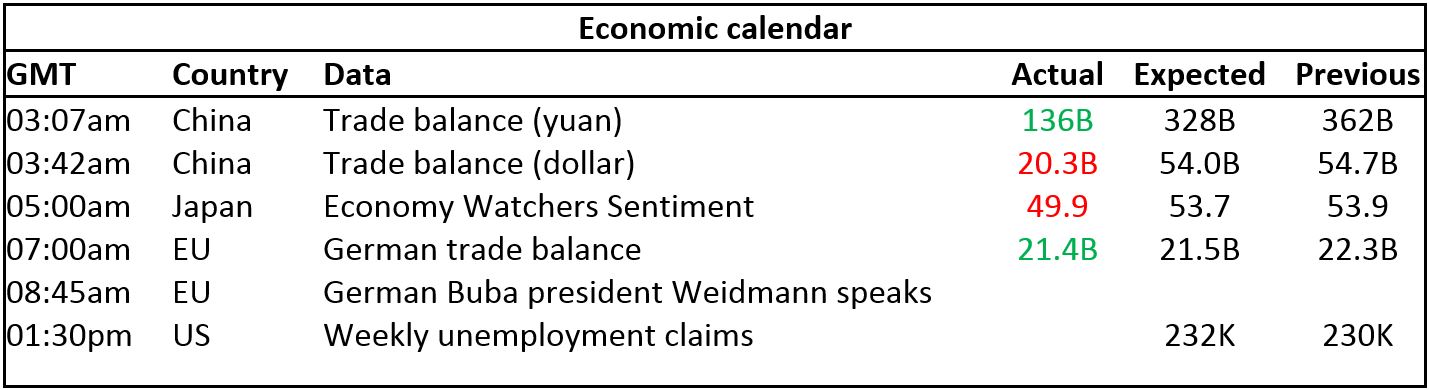

On the macro front, it was interesting to note yesterday that US Federal Reserve speakers did not take the recent market turbulence too seriously and therefore left their rate policy outlook unchanged. Earlier this morning, China and Germany offered their trade balances for January and December, respectively – China’s trade surplus came out much weaker than expected due to a surge in imports (resulting in yuan weakness) while German’s trade surplus was in line with market consensus. Later today, investors will pay attention to German Bundesbank President Jens Weidmann’s speech and scrutinize US unemployment claims.

We think the current macro environment is conducive for higher base metals prices. In consequence, the recent wave of fresh selling should prove temporary and lead to some short-covering. Most base metals enjoy robust micro dynamics. On this basis, we tend to prefer zinc and tin in so far as signs of tightening in present fundamentals are more visible, namely available stocks continue to fall at a fast pace while their forward curve is backwardated.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Precious metals prices could come under downward pressure in the immediate term appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News