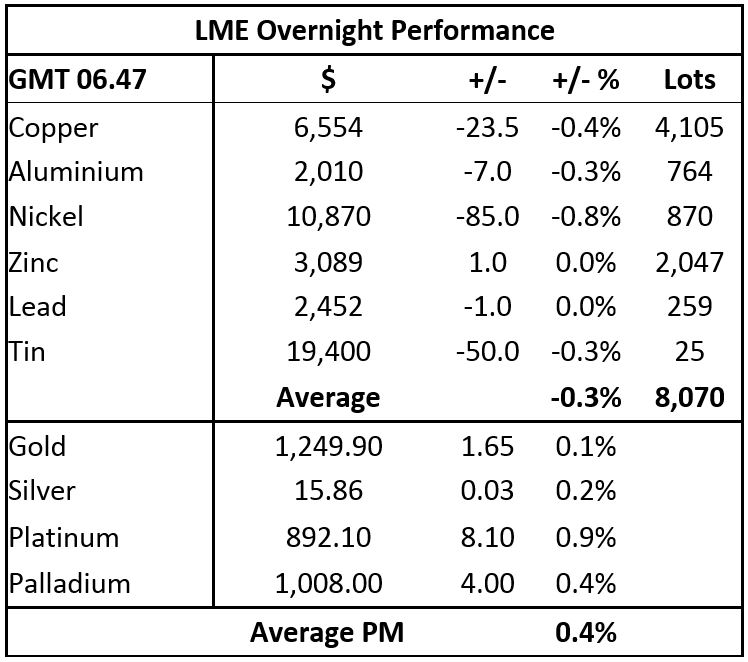

Precious metals are firmer this morning with gold prices up by 0.1% at $1,249.90 per oz, silver prices are stronger by 0.2%, palladium prices are up by 0.4%, while platinum prices have rallied 0.9%.

The precious metals sold off heavily last week, we think traders have been anticipating a likely interest rate rise at the US Federal Open Market Committee meeting on Wednesday. In addition, with equities booming and geopolitical tensions low, the opportunity cost of holding gold has been high, which has not helped. The current climate is not that bullish for gold so prices may remain under pressure for a while.

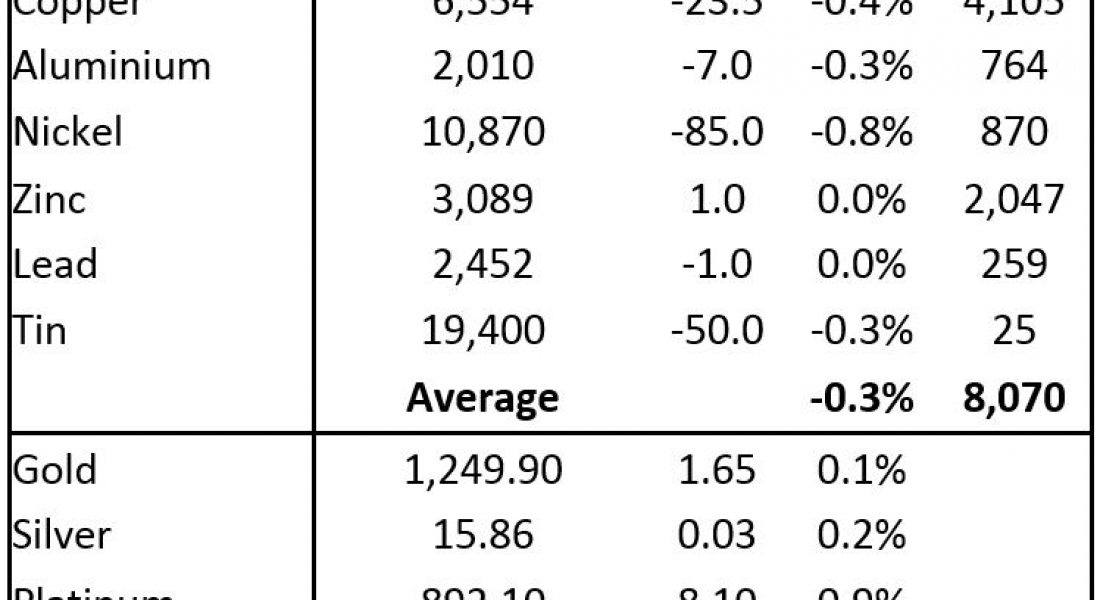

Base metals prices on the London Metal Exchange are for the most part weaker this morning, Monday December 11, with prices down by an average of 0.3% – led by a 0.8% drop in nickel prices while copper prices are down by 0.4% at $6,554 per tonne. Volume has been average with 8,070 lots traded as of 06.47 am London time.

This was after a generally firmer day on Friday, when copper, zinc and lead closed up between 0.3% and 0.5%, aluminium and tin prices were little changed and nickel prices fell by 0.5%.

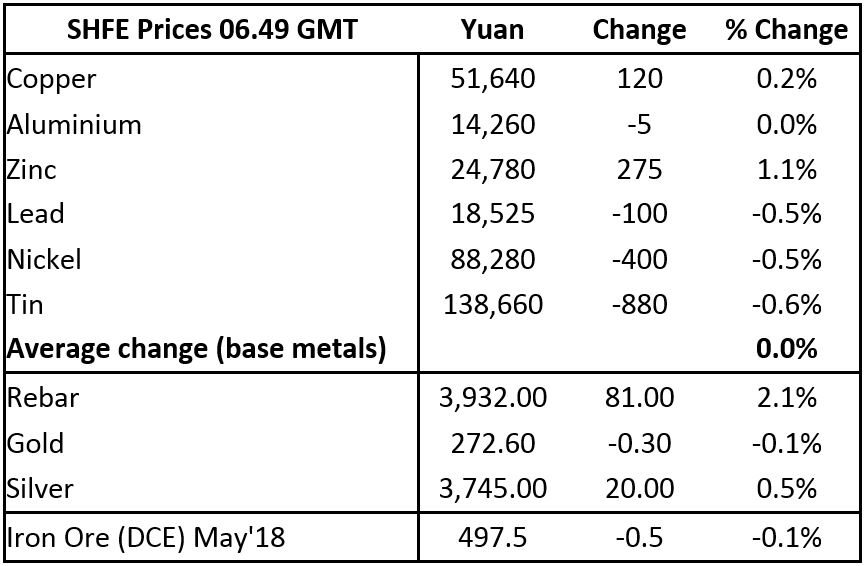

On the Shanghai Futures Exchange today, the base metals prices are mixed with lead, nickel and tin off between 0.5% and 0.6%, while zinc prices are up by 1.1%, aluminium prices are little changed and copper prices are up by 0.2% at 51,640 yuan ($7,804) per tonne.

Spot copper prices in Changjiang are up by 0.4% at 51,360-51,720 yuan per tonne and the LME vs Shanghai copper arbitrage ratio has firmed to 7.88, from 7.83 on Friday.

In other metals in China, iron ore prices are off by 0.1% at 497.50 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices are up by 2.1%, while gold prices are off by 0.1% and silver prices are up by 0.5%.

In international markets, spot Brent crude oil prices are up by 0.02% at $63.33 per barrel, the yield on US 10-year treasuries are little changed at 2.38% and the German 10-year bund yield is weaker at 0.30%.

Equities in Asia this morning are firmer with gains seen across the board: Nikkei (0.56%), the Hang Seng (0.95%), the CSI 300 (1.531%), the ASX200 (0.07%) and the Kospi (0.30%). This follows strength in western markets on Friday where in the United States the Dow Jones closed up by 0.49% at 24,329.16 and in Europe where the Euro Stoxx 50 closed up by 0.51% at 3,591.45.

The dollar index at 93.76 is consolidating, the latest rebound ran up to 94.09 on Friday, but the index has since dipped. The halt in the dollar’s rise has led to some firmness in the euro at 1.1786, sterling at 1.3423 and the Australian dollar at 0.7532, while the yen remains weak at 113.43.

The yuan remains flat at 6.6144, while the other emerging currencies we follow are consolidating.

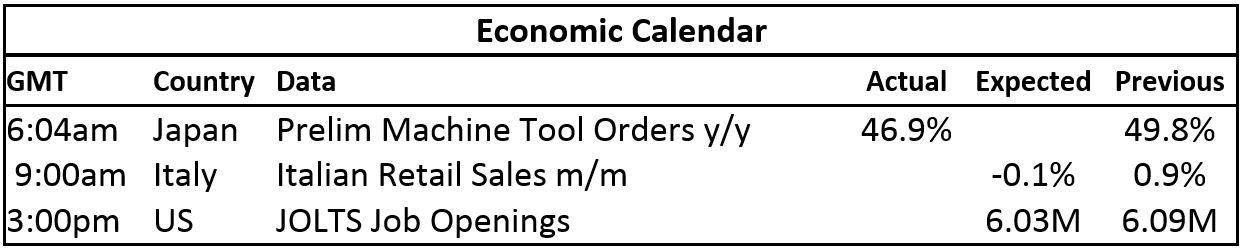

Today’s economic agenda is light: Japan’s preliminary machine tool orders were up by 46.9% year on year and later there is data on Italian retail sales and US job openings. Data out over the weekend showed China’s consumer price index climbed by 1.7% in November, after a 1.9% rise in October and producer prices climbed by 5.8%, which was as expected, but down from a 6.9% rise in October.

The base metals prices remain vulnerable to further falls; prices are consolidating for now, but the rebounds are not seeing much follow-through buying. So for now the path of least resistance seems to be to the downside.

Metal Bulletin publishes live futures reports throughout the day, covering major metals exchanges news and prices.

The post Quiet start to the week across the metals appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News