Each quarter FastMarkets and Sucden Financial produce an analysis and forecast report on the precious and base metals – The Sucden Financial Metals Reports, July 2016.

Below is the silver overview from the report, to download a PDF copy of the full report covering all the metals in pdf form click here.

Subscribers have access to these reports before they are published through the research tab in FastMarkets Professional.

Silver – Outperformance set to continue in Q3

Summary

Silver has been the star performer of the metals so far, enjoying a spectacular rally of 21.5 percent in the second quarter after a gain of 11.3 percent in the first, principally due to a strong rebound in speculative and investor demand. We expect silver’s outperformance to continue in the third quarter thanks to a cautious Fed but renewed selling pressure could appear in the fourth quarter due to weaker industrial demand and a possible pick-up in speculative and investor selling. In the meantime, silver appears overbought for this quarter and a possible spike above $22 should attract hedge selling.

Overall trend – In line with our expectations, silver rose to a fresh 2016 high in the second quarter due to stronger investor and speculative demand amid a supportive macro environment for precious metals. Silver also outperformed gold because the gold-silver ratio was historically too high, as we highlighted in our last report. It averaged 79 in the first quarter but has since reverted toward its longer-term (1980-present) average of 62, helped by reduced risk aversion – the VIX dropped to 15.69 in the second quarter from 20.54 in the first quarter. Silver might continue to perform better than gold in the third quarter because we expect the Fed to remain on hold and not adjust the market’s expectations about rate rises due to elevated uncertainty about the US outlook after recent disappointing data. But similarly to gold, we expect downward pressure in silver prices in the fourth quarter because US real interest rates are likely to bottom out once the Fed becomes more confident about preparing the market for a steeper path of rates. Although silver mine production may fall in 2016 after being stable last year, silver prices are likely to suffer from stronger scrap supply triggered by higher prices, weaker industrial demand – accounting for 54 percent of total silver demand – and renewed investor and speculative selling. We expect a $17 – $24 per ounce range in the third quarter.

ETF investors bought 302 tonnes in the second quarter after a record 745 tonnes in the first. Silver ETF demand is set to remain solid in the third quarter amid a supportive macro environment but some profit-taking is likely in the final quarter of the year, we feel.

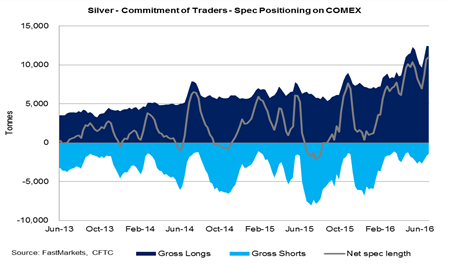

Money managers bought 4,712 tonnes in the second quarter and 5,284 tonnes in the first on Comex after selling 943 tonnes last year. Although spec positioning is clearly stretched on the long side, further spec buying is possible in the third quarter but should turn into strong selling in the fourth quarter, depressing prices.

The post Silver price forecast and analysis for Q3 2016 appeared first on The Bullion Desk.

Read More

Source: Bullion Desk News